Alva Park Costa Brava: A Failed Investment and Mounting Debts

A growing number of creditors from the ill-fated Alva Park Costa Brava project have recently joined Excelion Victims Board, shedding light on another problematic venture tied to the controversial real estate group. We cannot disclose most of the details here, but even from what can be shared, a pattern of amateurish, if not outright negligent, conduct emerges, to say the least.

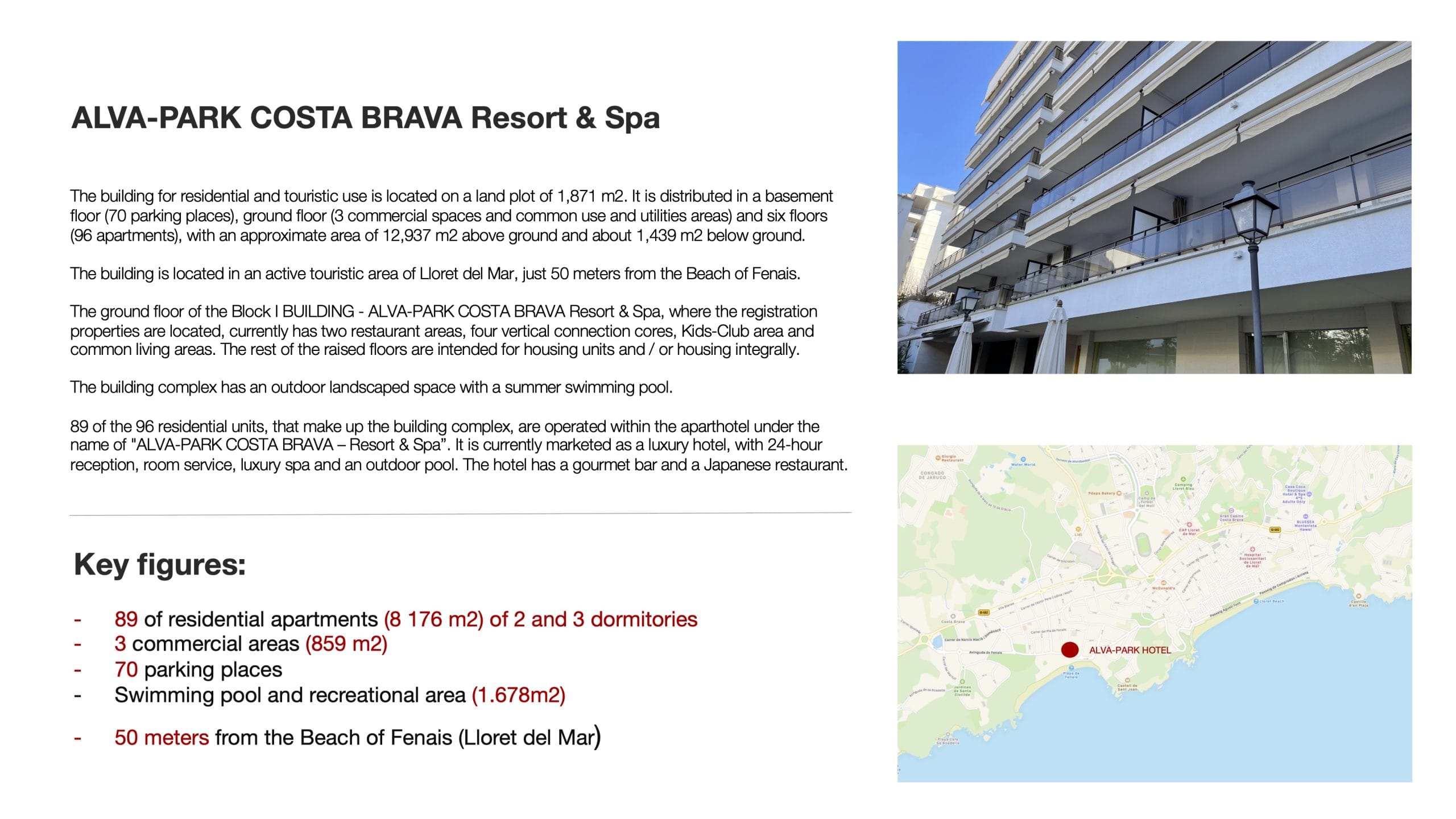

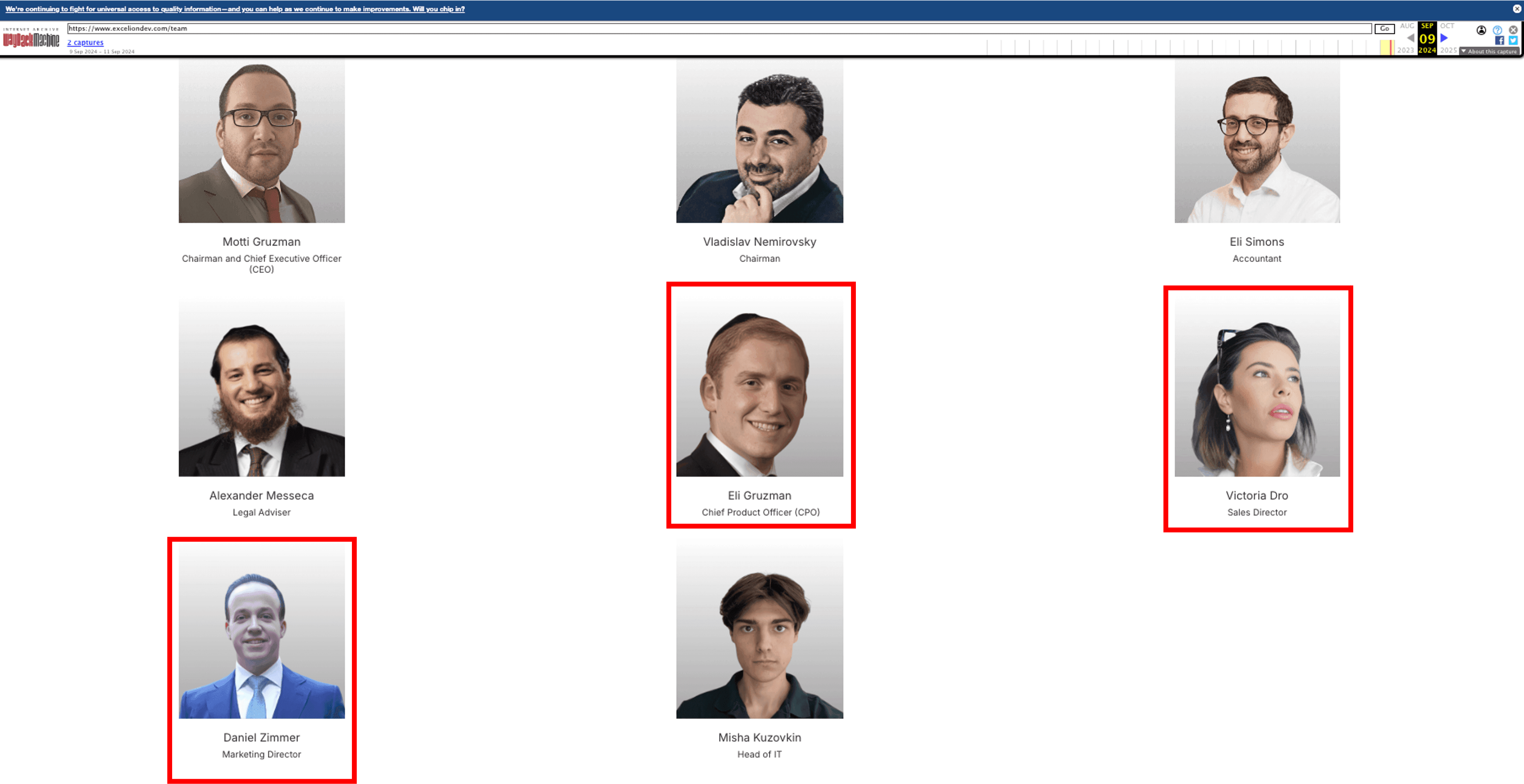

In April 2023, Vlad Nemirovsky and Motti Gruzman, owners of Excelion, established Lloret Capital Invest S.L.U. to acquire Alva Park Costa Brava, a once-luxurious five-star hotel turned apartment complex. The property, initially under a single owner, had been sold in 2020 due to financial distress and was divided among multiple owners. This fragmentation, with 89 apartments and 70 parking spaces owned by various entities, made the acquisition process inherently complex.

In April 2023, Vlad Nemirovsky and Motti Gruzman, owners of Excelion, established Lloret Capital Invest S.L.U. to acquire Alva Park Costa Brava, a once-luxurious five-star hotel turned apartment complex. The property, initially under a single owner, had been sold in 2020 due to financial distress and was divided among multiple owners. This fragmentation, with 89 apartments and 70 parking spaces owned by various entities, made the acquisition process inherently complex.

Despite lacking architectural or engineering expertise, Nemirovsky and Gruzman were captivated by the property’s high-end interior design and the potential for upmarket resale in Lloret de Mar. Relying on their own optimistic evaluations, they underestimated the renovation requirements, dismissing them as minor, and embarked on raising funds for the purchase.

Investor Funds and Rising Costs

In April 2023, Nemirovsky secured convertible loans from private investors in Israel and Russia to finance the initial acquisition phase. These loans were used to provide down payment (arras) for the first batch of 32 apartments while negotiations for the remaining units continued. However, delays in fundraising led to overdue payments, which increased the purchase price of the first portion. Simultaneously, other sellers raised their asking prices, further complicating the process. Excelion’s attempt to generate quick revenue through pre-sales faltered. Sample apartment renovation delays and restricted access for agents and buyers to the property hampered their marketing efforts. Worse, they set apartment prices 30-50% above market rates, driven by escalating acquisition and renovation costs.

In April 2023, Nemirovsky secured convertible loans from private investors in Israel and Russia to finance the initial acquisition phase. These loans were used to provide down payment (arras) for the first batch of 32 apartments while negotiations for the remaining units continued. However, delays in fundraising led to overdue payments, which increased the purchase price of the first portion. Simultaneously, other sellers raised their asking prices, further complicating the process. Excelion’s attempt to generate quick revenue through pre-sales faltered. Sample apartment renovation delays and restricted access for agents and buyers to the property hampered their marketing efforts. Worse, they set apartment prices 30-50% above market rates, driven by escalating acquisition and renovation costs.

Mounting Pressure and Risky Decisions

Despite these challenges, Nemirovsky and Gruzman persisted. In October 2023, they secured a high-interest loan from European private lenders trough Aexx Capital to finalize the acquisition of 59 apartments, temporarily shelving plans to purchase parking spaces.

Despite these challenges, Nemirovsky and Gruzman persisted. In October 2023, they secured a high-interest loan from European private lenders trough Aexx Capital to finalize the acquisition of 59 apartments, temporarily shelving plans to purchase parking spaces.

Yet, their troubles deepened as apartment sales stagnated across all Excelion projects. In a desperate move, Nemirovsky devised a scheme targeting Spanish Golden Visa applicants, proposing to sell apartments for €500,000 with a €150,000 "cash-back" disguised as prepaid rental fees. The plan, deemed risky and deceptive, was halted by Excelion’s financial management.

From Apartments to a Struggling Hotel

With no apartment sales materializing, Excelion pivoted to converting the property into a hotel. In July 2024, the building was handed over to Smart Rental, rebranded as Smartr Lloret de Mar. However, the hotel struggles to compete, offering rates nearly 50% lower than comparable properties in the area. While it maintains a modest 7.4 rating on Booking.com, its financial performance remains underwhelming.

With no apartment sales materializing, Excelion pivoted to converting the property into a hotel. In July 2024, the building was handed over to Smart Rental, rebranded as Smartr Lloret de Mar. However, the hotel struggles to compete, offering rates nearly 50% lower than comparable properties in the area. While it maintains a modest 7.4 rating on Booking.com, its financial performance remains underwhelming.

Investor Backlash and Looming Collapse

Frustrated Israeli and Russian investors, who had funded the initial acquisitions, are now pursuing legal action to recover their funds. With obligations personally tied to Nemirovsky and Gruzman, investors are exploring asset seizures in Israel, England, and Belgium. In addition, contractors and consultants who participated in securing the transaction and in the repair work are preparing their claims for overdue payments. Adding to the pressure, a substantial loan from European lenders matured in October 2024. Nemirovsky is scrambling to secure funds for the interest payment and negotiate a deferment on the principal. With no apartment sales and dwindling options, Excelion’s survival hinges on securing yet another loan—a risky bet on finding a more gullible or opportunistic lender.

Frustrated Israeli and Russian investors, who had funded the initial acquisitions, are now pursuing legal action to recover their funds. With obligations personally tied to Nemirovsky and Gruzman, investors are exploring asset seizures in Israel, England, and Belgium. In addition, contractors and consultants who participated in securing the transaction and in the repair work are preparing their claims for overdue payments. Adding to the pressure, a substantial loan from European lenders matured in October 2024. Nemirovsky is scrambling to secure funds for the interest payment and negotiate a deferment on the principal. With no apartment sales and dwindling options, Excelion’s survival hinges on securing yet another loan—a risky bet on finding a more gullible or opportunistic lender.

As the saying goes, “Suckers never end; they only change.”

For more, see: Ponzi Schemes | Real Estate Scams.